Bullish Bias, November Drawdown and the cost of not hedging

Hedge when there is a good opportunity!

I’m making this update public so everyone can see exactly what happened during a bad November. After having a green month every month this year, November was my first losing month, and it wasn’t pretty. I backed away from my original hedge plan at the last minute, and the portfolio paid the price with a preventable drawdown. Most substackers, including the top ones, had a bad month but they don’t want to talk about it. But unlike others, I will lay it out for everyone to see.

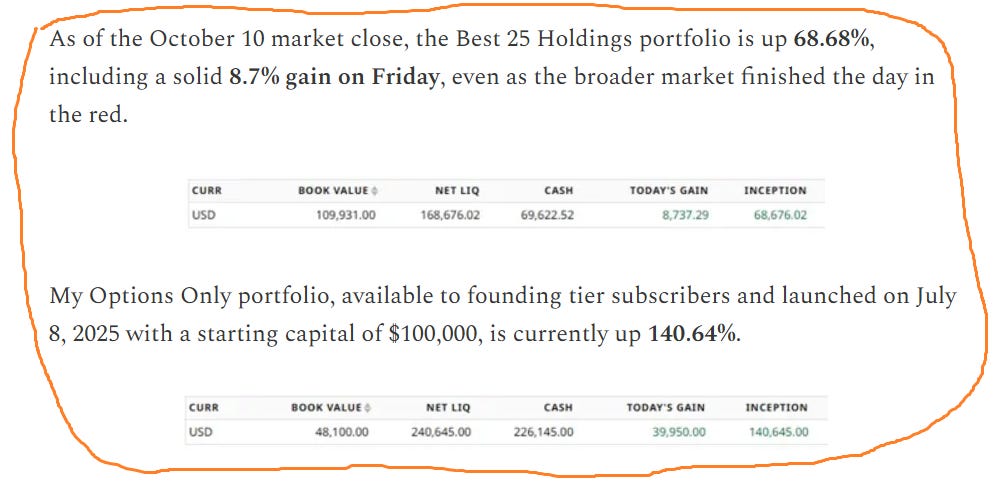

Here is where the portfolio was in my last update on October 12 which you can read in full following this link and a snippet of the summary is in below image.

Where the Portfolios Stand now (dec 5 market close)

Founding Tier Options only Portfolio

Launched July 7 with 100k. It is currently up about 84% as of Dec 5 market close. This is a large drawdown from the October peak where it was up more than 140%.

Best 25 Holdings Portfolio

Launched June 23 with 100k. It is now up about 15% since inception but was up almost 69% at the October peak.

What Happened After October 10

The short answer: my bullish bias, not hedging enough when the opportunity was perfect, rushing back into positions after the October rally, and rebuying & holding on to Bitcoin-related names longer than I should have.

The market had followed my projections all year up until after October 10. I caught the spring crash and the reversal perfectly. I was bullish through the summer and trimmed most long positions right before October 10 expecting the market to bottom later in the month.

After my October 12 update post I waited for SPX to dip into the 6300s from the 6550 Oct 10 close, but the opposite happened. The following Monday started a rally that lasted into month end and took the market to new all time highs. I expected new highs eventually but not before a proper bottom. Because my bias was already bullish, I rushed back into stocks and leaps on the first pullback in early November. I also re-entered Bitcoin exposure through IBIT and names like MARA and RIOT. These had been winners in the previous quarter for my portfolio and I bought them again using those profits.

At first it looked perfect. The early November dip reversed quickly and everything turned green. Going into the November 12 government funding vote, I was heavily long AI names, crypto-linked names, thematic names, and I added cheap 6950 and 6900 calls that were up multiples.

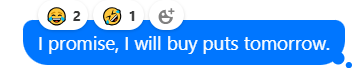

On November 11, I said in the members chat that I would finally add puts for downside protection.

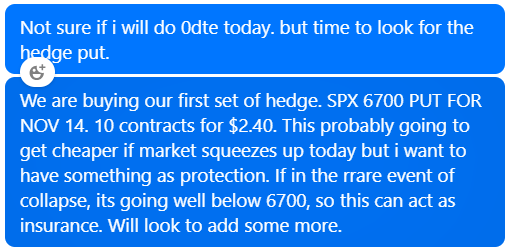

On November 12, SPX pushed toward 6870 and our calls were up 100 to 300 percent. Puts were still expensive but based on the setup I expected a 200 point move in either direction. That afternoon I bought the first batch of 6700 puts expiring November 14 when SPX was slightly above 6850. The plan was to build a total of 30 to 40 contracts in each portfolio.

The Hedging (lack of) Mistake

This is where the major mistake happened. I told subscribers that I am expecting a 200 point move from 6850 to either side with a heavy lean towards it going upwards. The plan was to buy batches of puts as hedge.

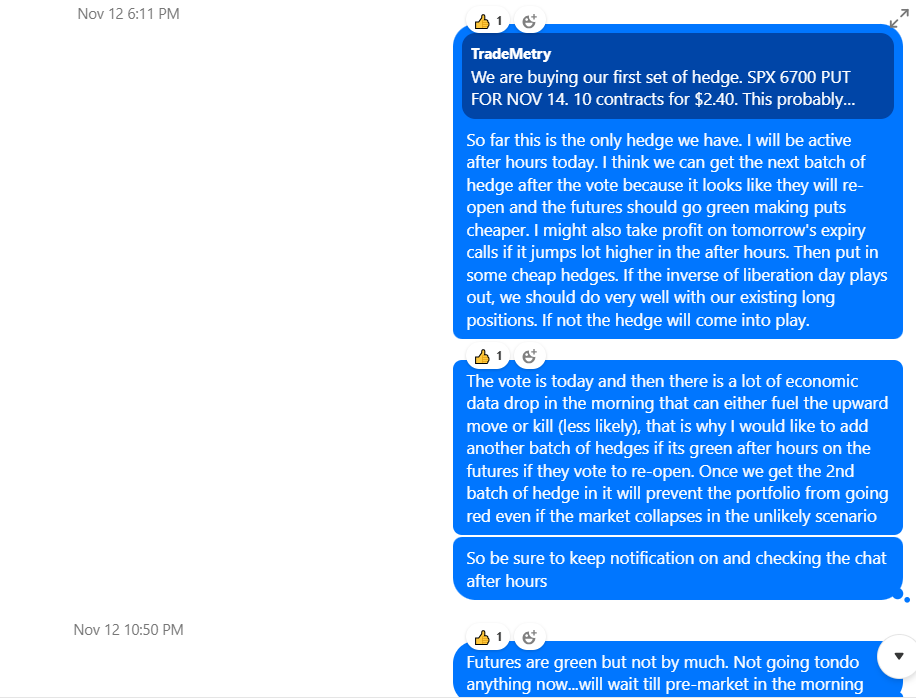

I only bought 10 puts. I planned to add more but let the bullish bias stop me. Here is what I posted after market close on Nov 12 and how I decided not to buy additional put hedges that night after the vote.

After the vote to reopen the government, futures were green and the 6700 puts were under 2 dollars. This was the easiest moment to add 30 to 40 more contracts because my original plan was to sell 10 of the contract for $10, another 10 for $20 and hold the rest for $50 if the 200 point move happened. The portfolio was heavily long and had plenty of cash. Not buying them ended up being extremely costly because the 200 point move did happen and it was to the downside.

Those puts later broke 10 dollars, then 20 dollars on thursday, and on Friday morning traded as high as 53 dollars after the market dropped 200 points from Wednesday’s close. I sold the 10 contracts I had for $10, but had nothing left to hold for the 20 or 50 dollar targets. If I had bought the additional batches, that hedge alone would have grown to more than 100 percent of the portfolio while costing only about 5 to 7.5 percent to enter.

Missing that hedge changed the entire month. It put me on tilt, led to uncharacteristic decisions, and hurt both portfolios for the rest of November.

Where Things Stand Now

Both portfolios are still positive since inception, but the November drawdown stands out. Quarter ending months like December are historically my strongest and I expect complete turn around. Price action since Thanksgiving has been slow but I expect movement to pick up after the FOMC this Wednesday.

I also still hold some positions expiring in January and February that I never closed and left for dead. If we get a Santa rally after some FOMC week weakness, any one of those could lift the portfolios significantly. But what is going to matter most is my next moves in December and how I deploy the remaining cash.

I’m ready for FOMC and the month of December, and aiming to take the portfolios to new highs. If there is any month you want to follow me on trades, it is quarter ending months. You can find all my moves, holdings live in the subscriber only chat. The next public update will come around January Opex. Thank you for reading.

Tough month. Thank you for the transparency. Looking forward to great December.

It would be impressive if you manage take both portfolio’s to new all time highs before the year is over.