Week Ending July 4 Summary

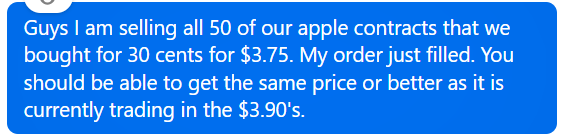

Closed $AAPL calls for 1150% gain!

This Week’s Changes

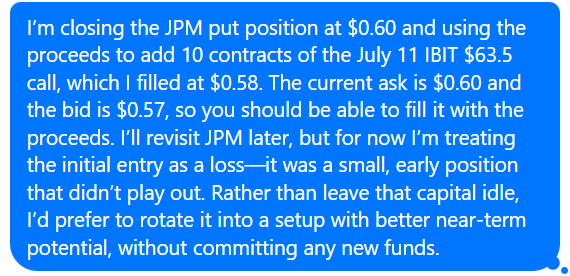

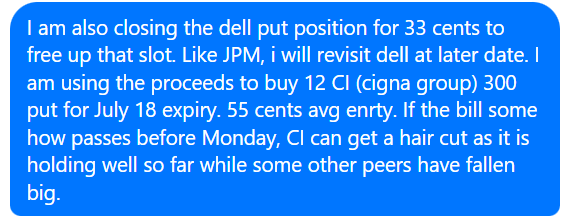

After adding a long position in Oncology Institute Inc (TOI) on wednesday, we locked in a 1,150% gain on our $AAPL calls on Thursday after a powerful run by closing all 50 contracts for $3.75. When we entered this apple position for 30 cents last Friday, I set the sell target as $5 but decided to close it early because I didn’t want to hold it through the long weekend with some Tariff drama setting up for next week. Earlier in the week we also rotated out of JPM and DELL puts and deployed into fresh setups like $IBIT and $CI. Our long book now has exposure to momentum, value, and macro themes, and we still have over $77K in available cash for further moves as Q3 unfolds. Expect a more aggressive rotation setup next week.

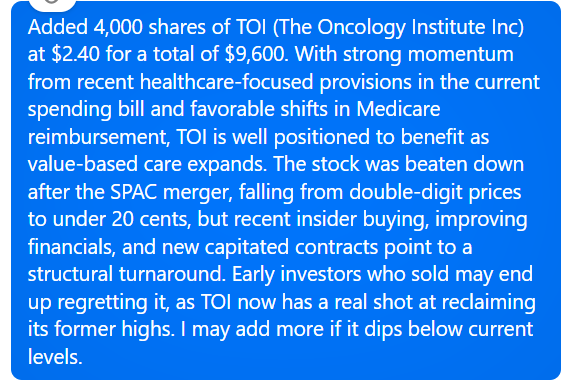

Added Long: $TOI – 4,000 shares @ $2.40 (Jul 2, 2025) = $9,600

Buy to Open: $DELL Jul 18 ’25 $110 Put – 20 contracts @ $1.40 (June 23, 2025) = $2,800Sold to Close @ $0.33 (Jul 2, 2025) = $660 (–76.4%)Buy to Open: $JPM Jul 18 ’25 $260 Put – 10 contracts @ $2.70 (June 23, 2025) = $2,700Sold to Close @ $0.60 (Jul 2, 2025) = $600 (–77.8%)Buy to Open: $IBIT Jul 11 ’25 $63.5 Call – 10 contracts @ $0.58 (Jul 2, 2025) = $580

Buy to Open: $CI Jul 18 ’25 $300 Put – 12 contracts @ $0.55 (Jul 2, 2025) = $660

Buy to Open: $AAPL Jul 11 ’25 $215 Call – 50 contracts @ $0.30 (June 27, 2025) = $1,500Sold to Close @ $3.75 (July 3, 2025) = $18,750 (+1,150%)All these were sent live in our members chat during market hours then it was posted after market closed for the public in case anyone who wanted to tag along. Below are the screenshot of the live posts in the members chat.

Portfolio Summary (as of July 4, 2025)

Equity Positions

Long:

$OXY – 100 shares @ $43.85 (June 23, 2025) = $4,385

$SLB – 150 shares @ $34.00 (June 23, 2025) = $5,100

$GOOGL – 40 shares @ $163.00 (June 23, 2025) = $6,520

$HAL – 200 shares @ $20.85 (June 23, 2025) = $4,170

$ETHA – 300 shares @ $18.39 (June 26, 2025) = $5,517

$AAPL – 100 shares @ $201.00 (June 27, 2025) = $20,100

$TOI – 4,000 shares @ $2.40 (Jul 2, 2025) = $9,600

Short:

$MSFT – 10 shares @ $487.00 (June 23, 2025) = +$4,870

$TSLA – 25 shares @ $355.00 (June 23, 2025) = +$8,875

$NVDA – 50 shares @ $144.40 (June 23, 2025) = +$7,220

Options Positions

Buy to Open: $DELL Jul 18 ’25 $110 Put – 20 contracts @ $1.40 (June 23, 2025) = $2,800Sold to Close @ $0.33 (Jul 2, 2025) = $660 (–76.4%)Buy to Open: $FANG Sep 19 ’25 $160 Call – 15 contracts @ $3.90 (June 23, 2025) = $5,850

Buy to Open: $JPM Jul 18 ’25 $260 Put – 10 contracts @ $2.70 (June 23, 2025) = $2,700Sold to Close @ $0.60 (Jul 2, 2025) = $600 (–77.8%)Buy to Open: $ETHA Jul 18 ’25 $20 Call – 20 contracts @ $0.61 (June 26, 2025) = $1,220

Buy to Open: $AAPL Jul 11 ’25 $215 Call – 50 contracts @ $0.30 (June 27, 2025) = $1,500Sold to Close @ $3.75 (July 3, 2025) = $18,750 (+1,150%)Buy to Open: $IBIT Jul 11 ’25 $63.5 Call – 10 contracts @ $0.58 (Jul 2, 2025) = $580

Buy to Open: $CI Jul 18 ’25 $300 Put – 12 contracts @ $0.55 (Jul 2, 2025) = $660

Updated Cash Balance

Starting Cash: $100,000

Less Long Equities: –$55,392

Less Options Premiums Paid (open only): –$8,310

Add Proceeds from Shorts: +$20,965

Add Net Gains from Closed Options (after cost): +$13,010

Current Cash Balance: $70,273

Note: I am working on a comprehensive spreadsheet that will track the portfolio live with PNL and as well as every single log since inception. Until it is finalized, I will just list the current holdings and log like this.

Founding Member Options Trades Update

If you’re comfortable trading options and can allocate a dedicated bankroll for them in your trading account, consider joining as a founding member to get access to our options only portfolio. Markets are expected to be volatile going into the 2030’s and options only dedicated portfolios can vastly outperform regular portfolios if done correctly. So far founding members have close 2 short term trades for over 500% and over 300% respectively. We are also currently in the process of accumulating another big position slowly with expiry in September that should bring us epic returns.

How do I get into the chat?