2026, Yen Carry Trade, Market Correction, New Fed Chair, Midterms

2026 a year for Swing Traders!

On December 19, 2025, the Bank of Japan (BOJ) raised its policy interest rate to 0.75%. While this move was widely expected, its significance lies in the potential to trigger another “unwind” of the Yen Carry Trade. To prevent a year-end market collapse, the US Federal Reserve and the Treasury Department have launched a massive, coordinated liquidity defense.

The Mechanism: Why Japan Moves the US Market

The “Yen Carry Trade” is a global financial engine where investors borrow Yen at near-zero interest rates to buy US assets like stocks and bonds. When Japan raises rates, that borrowed money becomes more expensive. This forces investors to sell their US assets to pay back their Japanese loans.

When thousands of hedge funds sell at once, US market prices drop. These drops are often blamed on news events like “tariffs” or “geopolitics,” but the underlying cause is frequently a sudden shortage of Yen-funded liquidity. Since BOJ started raising rates in 2024, all major US market correction has come directly after each time BOJ raised rates.

Historical Review: BOJ Hikes and the Fed’s Response

The following table details the major Japanese rate hikes of the last two years and the specific “emergency” measures the US government used to stabilize the markets.

The 2025 “Spring Collapse”: A Warning for 2026

The 19% market crash between February and April 2025 serves as a critical case study. While the public narrative blamed the “Liberation Day” tariff announcements, the market had already been made fragile by the January BOJ hike.

The Hike (Jan): Removed the “cheap money” safety net.

The Chop (Feb): Markets traded sideways as carry traders began to exit.

The Catalyst (Mar/Apr): Tariffs acted as the final blow to an already illiquid market, leading to a violent 19% drawdown.

Current Defense: The December “Liquidity Wall”

The US government is currently using three major tools to ensure the December 19 hike doesn’t trigger a similar crash:

The Standing Repo Facility (SRF): On October 31, 2025, the Fed executed a $29.4 billion repo operation—the largest in 20 years. This tool allows banks to instantly swap bonds for cash, preventing a “liquidity freeze.”

Treasury Buybacks: The Treasury has expanded its “Cash Management” buybacks to $150$ billion per year. Today, they conducted a $2 billion targeted buyback of 20-30 year bonds to support the most sensitive part of the market.

Fed Bill Purchases: On December 12, the Fed began a 30-day program to buy roughly $54 billion in short-term government debt. This provides a constant “bid” in the market, making it harder for prices to fall.

2026 Projections: The June Collision and Powell’s Exit

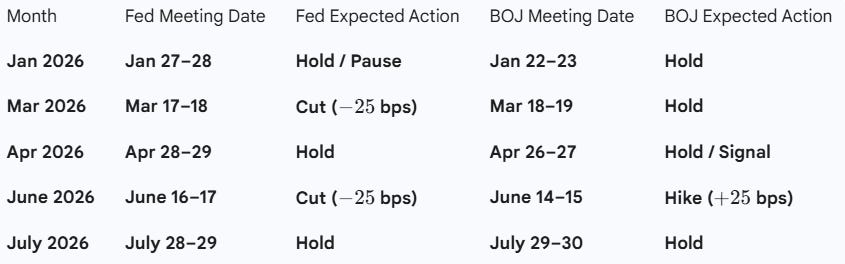

While current measures may protect the market through the holidays, a structural risk emerges in the 1st half of 2026. Jerome Powell’s term as Fed Chair ends on May 15, 2026. This leadership transition occurs just weeks before a projected "collision" in global interest rates. If the Fed continues to cut while the BOJ continues to hike, the interest rate gap will vanish entirely. Below table shows the next 5 meetings and the expected decision.

The Risk: In June 2026, the Fed and BOJ are expected to move in opposite directions during the same week. This simultaneous move will narrow the interest rate gap by 50 basis points in just 48 hours. Historically, this type of "collision" is the most dangerous environment for US stocks.

Conclusion: The Path Forward

The Fed and Treasury have successfully built a “liquidity cushion” that makes a December crash unlikely. The most probable scenario is that the Fed keeps the market propped up through the New Year. However, based on the 2025 pattern, the real test will come in the first half of the year, leading into the high-risk “collision” window in June 2026. At that point, a new Fed Chair will be forced to manage the final stages of the Yen Carry Trade unwind.

As this is also a midterm election year, the administration will likely do everything possible to avoid a total market collapse. Nevertheless, a double-digit correction in the first half of the year seems probable. Timing will be the critical factor. With heavy Fed interference, assets may experience a “short squeeze” to the upside before a significant drop, or the current tug-of-war could keep us in the same range-bound action we’ve seen since October before the eventual move lower. This drawdown could occur in waves over several months to bottom in June or happen quite rapidly. Weather its total market collapse or another epic rally with heavy government intervention remains to be seen.

As we manage our swing trading portfolios, we will remain highly disciplined. Our goal is to stay defensive while capturing the volatility in both directions as these cycles play out. Portfolio updates and moves will be posted in the subscriber chat.

Solid work 💪🏼

Very Interesting read. I never noticed how every American Market correction happened right after each of BOJ hike since BOJ started hiking in 2024. First two hikes were under .25 bps and the correction was mild. Third one was .25 bps in late January 2025 and the correction that followed in the American Market was almost 20%. This Friday’s BOJ hike was also for .25bps. Yikes.