2025 and 2026 Portfolio Update

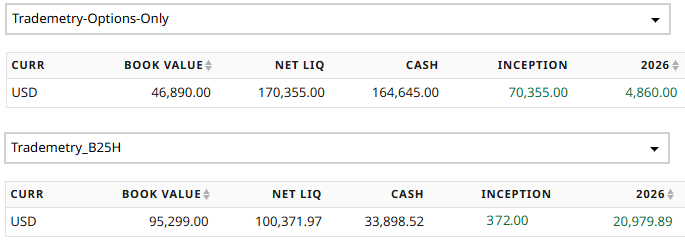

In terms of new activity, we did very little in December and January so far as we allowed the post October and November drawdown positions to play out, but we expect more positive activity starting this week. The founding tier options only portfolio, which launched in early July with 100k, is up about 70 percent and is currently holding roughly 165k in cash, with the remaining positions being the failed October/Nov rebalance trades that could either push the portfolio higher if they work or still leave it up about 65 percent if they expire worthless.

The regular tier stocks and options portfolio, launched in late June with 100k, is now slightly above break even after briefly going negative during the drawdown, as many of the mistimed October and November trades rebounded strongly in late December and January. On the equity side we are positioned in two robotics names, $PATH and $OUST, two under the radar critical minerals penny stocks, $ARSMF and $CTVFF, which we believe can break $1 this year, along with $OPEN, now the second largest allocation after cash and one we are very bullish on for 2026 given new management and a push to bring mortgage rates down, plus a small position in $GME, and with the exception of GME all of these remain attractive buys at current levels for 2026.

Subscribers who came on board in early and mid December, got some great entries well below my price. They were also able to take advantage of some of the options at much better strikes and cash in on the rallies. However, myself and those who were here through the October/November rebalance are patiently waiting to re-capture the Portfolio ATH from Mid October and the time is here for new re-positioning. We are going to have a great new year. If you joined in October and gave up in because of the drawdown, this is a great time to jump back in.

Reminder that there is 2026 50% discount offer running this weekend that will expire when Market opens on January 12th. This discount offer includes performance guarantee of at least 50% gains for both portfolios for those who join and stay with me till the end of the year. If the performance guarantee is not met, 2027 will be comped free of charge. This year is going to be amazing with good amount of volatility making it another great year for swing traders and that is why I can confidently add performance guarantee. You can take advantage of this offer here https://www.trademetry.com/86275b20. The link only discounts the regular tier portfolio, so I have temporarily changed the founding Tier to $2500 from $5000 in the website until this offer ends. I usually give 10% additional discount for crypto users, but in this offer its additional 30% making the total cost $1775 to get full access to everything with 50% performance guarantee. If interested in this, DM me. For tracking performance guarantee, it will begin on all new positions starting January 12th for options and for shares it will start counting with already held shares from the opening price on January 12th and all new share positions that we may take this year. This is the flash offer that will expire when market opens January 12.

This is the only substack where every single portfolio transaction is accounted for with date, exact entry/exit costs in an organized log that can be cross-checked with all live posts. To put into perspective, try asking Citrini Research, largest finance substack, to show his transaction history and he will ask you to pay another subscription just for that and still will not give you a clear tracking while taking you for a while spin!